The recent gold price dynamics reflects the complex interplay between economic indicators and market sentiment: the price moves in response to changes in the US economic indicators and Federal Reserve policy expectations.

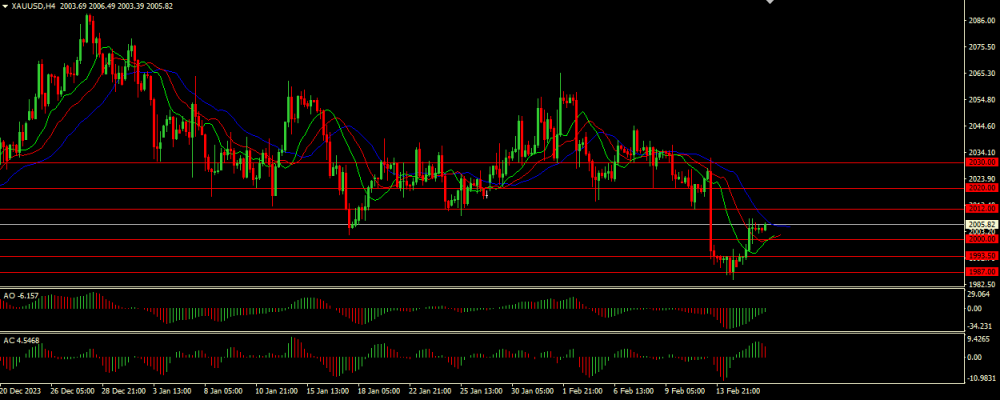

After a strong break of the 2000.00 support level and a further decline to 1984.20, gold prices rose on the back of a sharp fall in US retail sales in January, the largest monthly decline since February 2023, and a drop in jobless claims, a sign that the labor market is strong, reflecting a robust economy. These factors, along with a weaker dollar and falling government bond yields, are making gold more attractive to international investors.

Read more

Read more