Fundamental analysis of XAU/USD

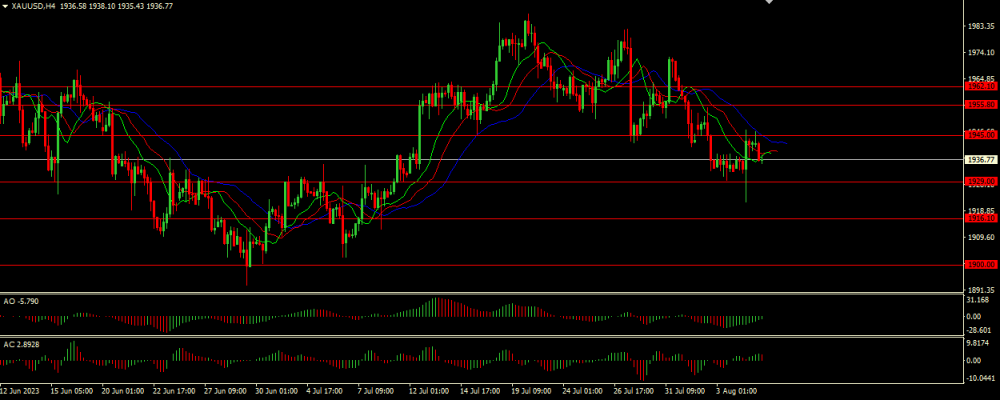

XAU/USD is currently in swing territory, trading at 1937.00 as traders ponder the potential impact of U.S. labor market trends and upcoming inflation data on the direction of U.S. monetary policy. While a weaker dollar and lower bond yields have supported the precious metal, the way forward remains unclear.

Current market conditions have been driven primarily by slowing US job growth, which has weakened the dollar and bond yields, and contributed to gold's rally last Friday. The U.S. jobs report for July showed slower than expected job growth, indicating that the labor market may be stabilizing. This suggested that the recent Fed rate hike could be the last in an ongoing tightening cycle. However, strong wage growth and a declining unemployment rate suggest that the labor market remains tight, providing an opportunity to assess the Fed's future interest rate decisions. In light of these mixed signals from the labor market, attention now turns to the upcoming consumer price index (CPI) data due on Wednesday. This data will be key in determining whether further rate hikes are needed to curb inflation. If interest rates rise, gold, traditionally a hedge against inflation, could lose its appeal.

Read more