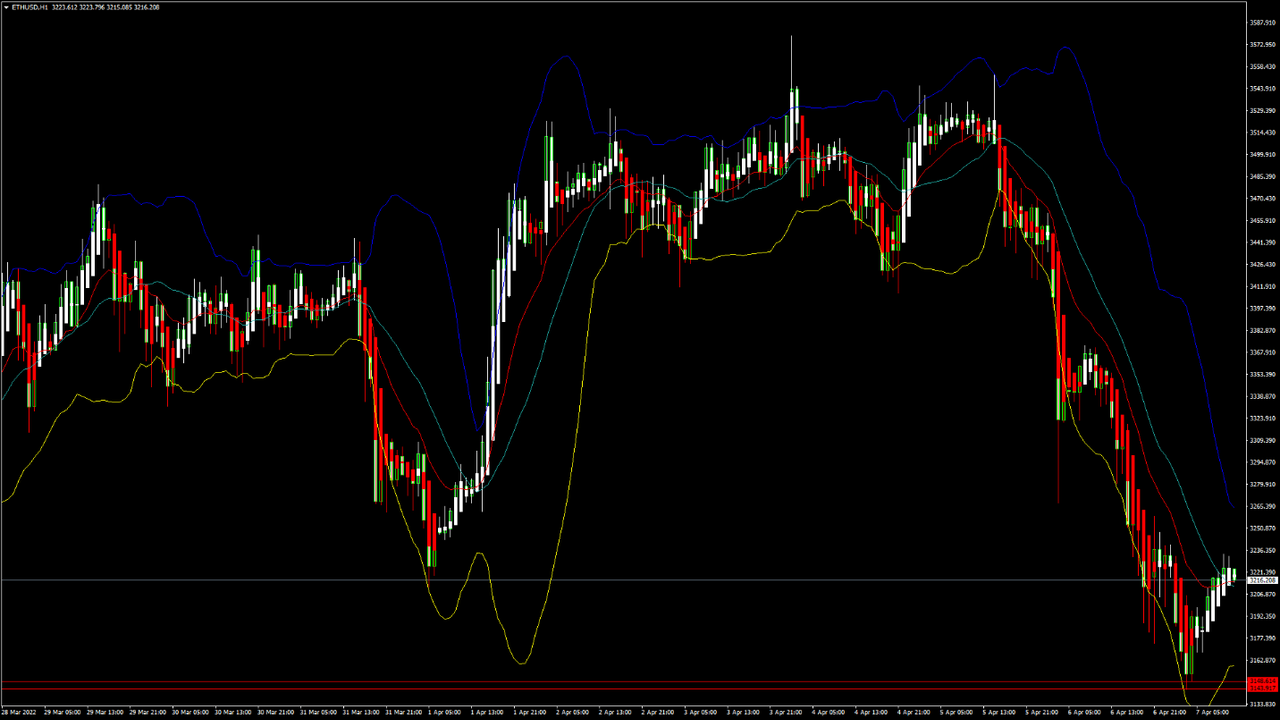

ETHUSD and LTCUSD Technical Analysis ? 07th APR, 2022 ETHUSD: Double Bottom Pattern Above $3,100

ETHUSD: Double Bottom Pattern Above $3,100Ethereum failed to continue its bullish momentum last week, and after touching a high of 3578 on April 4th, has started to decline.

Ethereum touched an intraday low of $3,143 in the Asian trading session, and an intraday high of $3,233 in the European trading session today.

We can clearly see a double bottom pattern above the $3,100 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of $3,223 and moving in a mildly bullish channel. The price of ETHUSD is now testing its classic resistance level of $3,235 and Fibonacci resistance level of $3,246, after which the path towards $3,400 will get cleared.

The relative strength index is at 44 indicating a WEAK demand for Ethereum and the move towards consolidation.

Both the StochRSI and the Williams percent range are indicating an overbought level which means that the price is due to decline further.

Most of the technical indicators are giving a STRONG BUY market signal.

Some of the moving averages are giving a BUY signal, and we are now looking at the levels of $3,400 to $3,550 in the short-term range.

ETH is now trading below both the 100 hourly and 200 hourly simple moving averages.

- A bullish reversal seen in Ether above the $3,100 mark

- The short-term range appears to be mildly BULLISH

- The daily RSI is near 50 at 53, indicating a NEUTRAL market

- The average true range is indicating LESSER market volatility

Ether: Bullish Reversal Seen Above $3,100

ETHUSD is now moving into a mildly bullish channel with the price trading above the $3,200 handle in the European trading session today.

We saw last week that the bullish move was invalidated above the $3,500 handle, and this week, we are looking at the level of $3,400. If ETH manages to cross and remain above these levels, then we can see $3,500 and $3,600 next week.

Ethereum is now slowly recovering against the US dollar, and we can see the formation of an ascending contraction triangle which means that the prices are due to break out upwards.

ETHUSD is now facing its immediate resistance levels of $3,337 and $3,417, after which we will see a linear progression towards $3,600.

The key support levels to watch are $3,175 and $3,153, and the prices of ETHUSD need to remain above these levels for the bullish trend to continue.

ETH has lost -4.00% with a price change of -133.99$ in the past 24hrs, and has a trading volume of 22.874 billion USD.

We can see a 8.29% decrease in the total trading volume in the last 24 hrs, which appears to be normal.

The Week AheadLast week, we saw Ethereum decline from its highs of $3,579 to the low of $3,143, but now we can see that the prices have entered into a consolidation phase above $3,200.

If the price of ETHUSD remains above $3,200, we may see a linear progression towards the level of $3,400 and $3,500 this week.

The immediate short-term outlook for Ether has turned mildly BULLISH; the medium-term outlook has turned neutral; and the long-term outlook for Ether is NEUTRAL in present market conditions.

This week, Ether is expected to move in a range between $3,200 and $3,400, and next week, Ether is expected to enter into a consolidation phase above the level of $3,400.

On-Chain Metrics

We can see that the number of active Ethereum addresses are increasing, and it also points to an increase in the price of ETH next week.

The simple moving average (14-day) of the active receiving addresses also suggests that more buyers are now coming back into the markets, which has led to an increase in the number of Ethereum transactions.

Technical Indicators:The Stoch (9,6): at 74.29 indicating a BUY

The average directional Change (14-day): at 54.71 indicating a BUY

The commodity channel index (14-day): at 74.31 indicating a BUY

The ultimate oscillator: at 62.37 indicating a BUY

Read Full on FXOpen Company Blog...