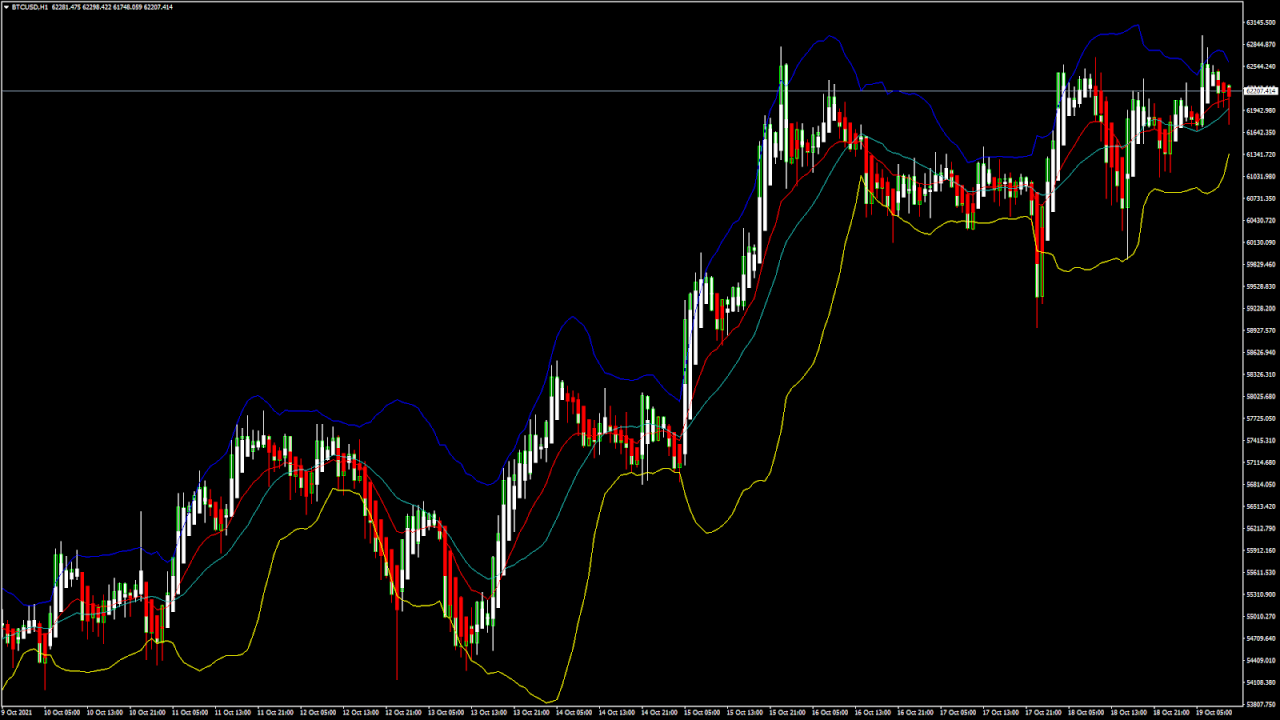

BTCUSD and XRPUSD Technical Analysis ? 19th OCT, 2021 BTCUSD: Bitcoin Rally Towards $65k Confirmed

BTCUSD: Bitcoin Rally Towards $65k ConfirmedBitcoin continues to consolidate its gains and has touched a 6-month high of $62,965 in the Asian trading session. Since the price of BTC has already crossed its major resistance levels of $62,232 today, we may see some consolidation in the levels towards sub $62,000 handle in the US trading session.

Bitcoin is trading above its both 100 hourly and 200 hourly moving averages. The rally in BTC continues with fresh buying support seen after it touched an intraday low of $61,100 today in the early Asian trading session.

Bitcoin is moving in a strong bullish momentum, and a fresh rally is expected to push its prices above the $65,000 handle this week.

The medium to long-term outlook for bitcoin remains bullish with immediate targets for today at $63,200.

- Bitcoin is holding above its major resistance levels of $58,462, indicating more upsides

- Consolidation in the prices is expected after touching a 6-month high towards $61,400 level

- The price is now trading above its classic support level of $61,860

- All the moving averages are giving a STRONG BUY signal at current market levels of $62,108

Bitcoin Consolidating Its Gains Above $60k

BTCUSD is gaining momentum. Its price continues to remain above the important psychological level of $60k. At the moment, the price of BTCUSD is facing a Fibonacci resistance level of $62,531, and Woodies resistance level of $62,798, after which the path towards $63,000 will be cleared.

In the last 24hrs, BTCUSD has risen UP by +0.83% / +825$ and has a 24hr trading volume of USD 39.152 billion.

Bitcoin Acceptance IncreasesThe global acceptance of bitcoin is growing. The number of BTC transactions continues to increase, which leads to its higher demand on cryptocurrency exchanges.

This year, residents of Brazil have bought 4 billion USD worth of crypto, including bitcoin. Brazil is expected to pass a bill to legalize bitcoin as legal tender.

Investments in bitcoin are expected to grow as well, with the listing of bitcoin exchange traded funds (ETFs). Some crypto analysts believe that bitcoin ETFs will allow billions of dollars managed by pension funds and other institutional investors to flow into bitcoin.

The Week AheadThe price of BTCUSD is holding above $60,000, and after some consolidation, the bullish uptrend movement will start pushing its price above the $63,000 handle.

If the prices of BTCUSD continue to remain above the $63,000 mark this week, we may see a fresh rally towards $65,000 in the markets in the opening of the next week.

Both the medium- and long-term outlooks remain positive. Next week, we may witness BTC printing at above the $65,000 mark.

Technical Indicators:Ultimate oscillator: at 58.88 indicating a BUY

Rate of price change (ROC): at 0.653 indicating a BUY

Moving averages convergence divergence (12,26): at 228.80 indicating a BUY

Relative strength index (14-day): at 55.39 indicating a BUY

Read Full on FXOpen Company Blog...