Rising US Inflation Supports the Bullish Case for Gold

Last week, two events dominated the price action in financial markets ? the US inflation and Fed Chair Powell?s semiannual testimony. Both brought a new perspective to market participants, but summer trading conditions eventually prevailed.

Namely, despite the rising inflation environment and the market-moving statements from the Fed Chair, the market did not move much. It is typical for the market to consolidate during the summer months, and so July and August are known as months with declining volatility.

Rising Inflation ? Bullish for Gold and Equities

Rising Inflation ? Bullish for Gold and EquitiesThe US inflation data for the month of June showed inflation surging. It reached 5.4% YoY, much higher than expectations. In fact, inflation in the United States did not reach such levels for at least three decades.

Traders should remember that last year, in August, the Fed shifted its price stability mandate. It moved from targeting 2% to averaging 2% inflation. Therefore, higher inflation above 2% is not quite a concern for the Fed because we do not know what it is the period used for averaging.

In other words, if the Fed considers the last 12 months or more, then inflation is likely to be below the 2% AIT (Average Inflation Targeting) target. Because of that, the semiannual testimony that the Fed Chair held last week was critical for understanding how the Fed views inflation.

Fed Powell admitted that the central bank is surprised by how hot inflation is running, but he reiterated the fact that the Fed views it as transitory. We will find out further down the road if that is true or not.

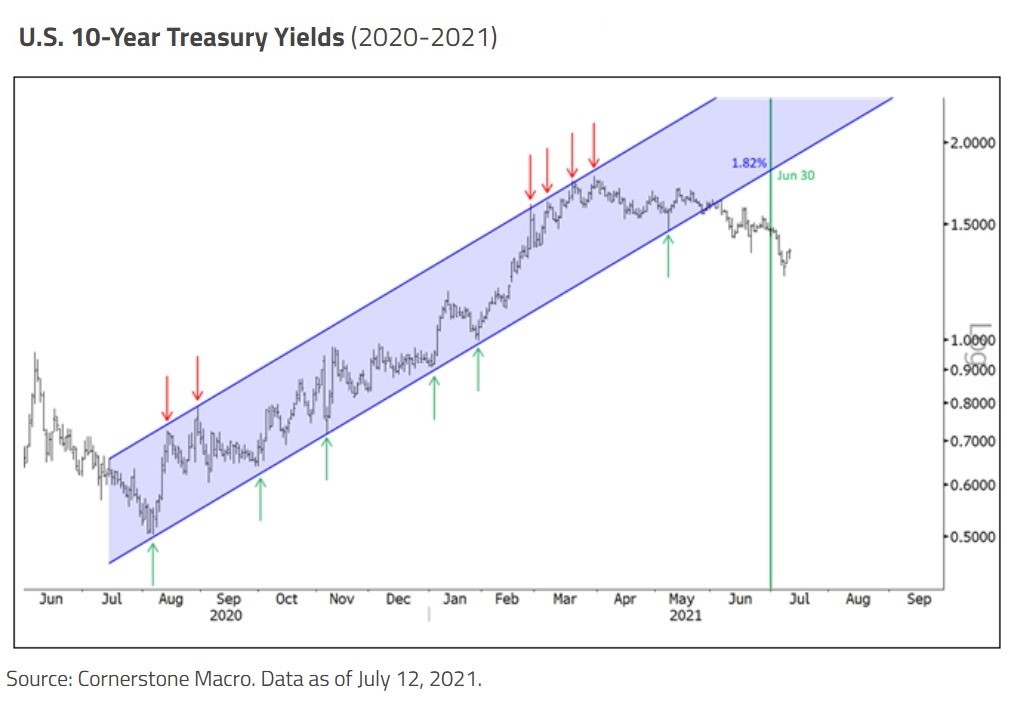

In the meantime, with inflation at 5.4% and the US 10-Year Treasury yield at 1.3%, we talk about a negative 4.1% real yields. Therefore, investors are forced to look for alternatives.

One is gold. Commodities have typically served against higher inflation and this time should be no different. The price of gold, therefore, traded with a bid tone last week, rising from below $1,800 at the time inflation data was released, to over $1,830 before giving back some gains.

Another is the stock market. The US equities have outperformed their peers and keep trading close to their highs. The earnings season started strong, with financial services corporations posting strong earnings for the second quarter. If the trend continues, funds will keep pouring into the stock market.

All in all, rising inflation bodes well for gold and equities. The next thing to monitor is the tapering of the asset purchases from the Fed. It may be announced as soon as the Jackson Hole Symposium in August, if inflation keeps rising.

FXOpen Blog