Gold Price Trims Gains While Oil Price Turns Bullish Above $50 Gold price started a downside correction after surging towards $1,960. Conversely, crude oil price is following a strong bullish path and it settled above $50.00.Important Takeaways for Gold and Oil

Gold price started a downside correction after surging towards $1,960. Conversely, crude oil price is following a strong bullish path and it settled above $50.00.Important Takeaways for Gold and Oil- Gold price started a fresh increase towards $1,950-$1,960 and recently corrected lower against the US Dollar.

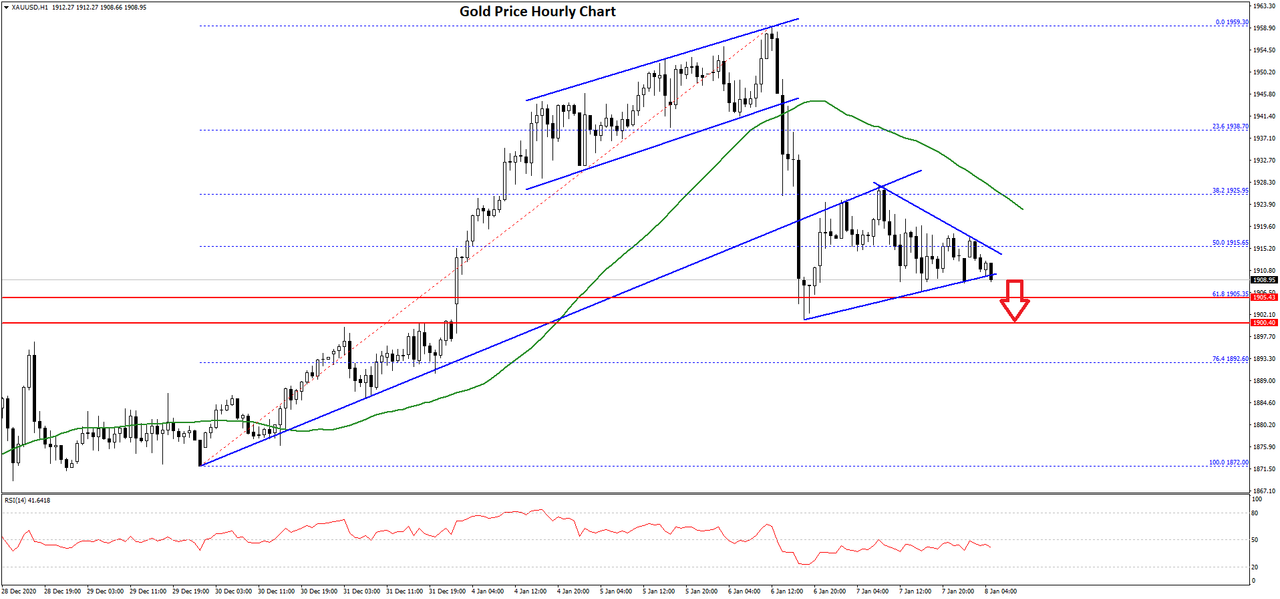

- There was a break below a major bullish trend line with support near $1,920 on the hourly chart of gold.

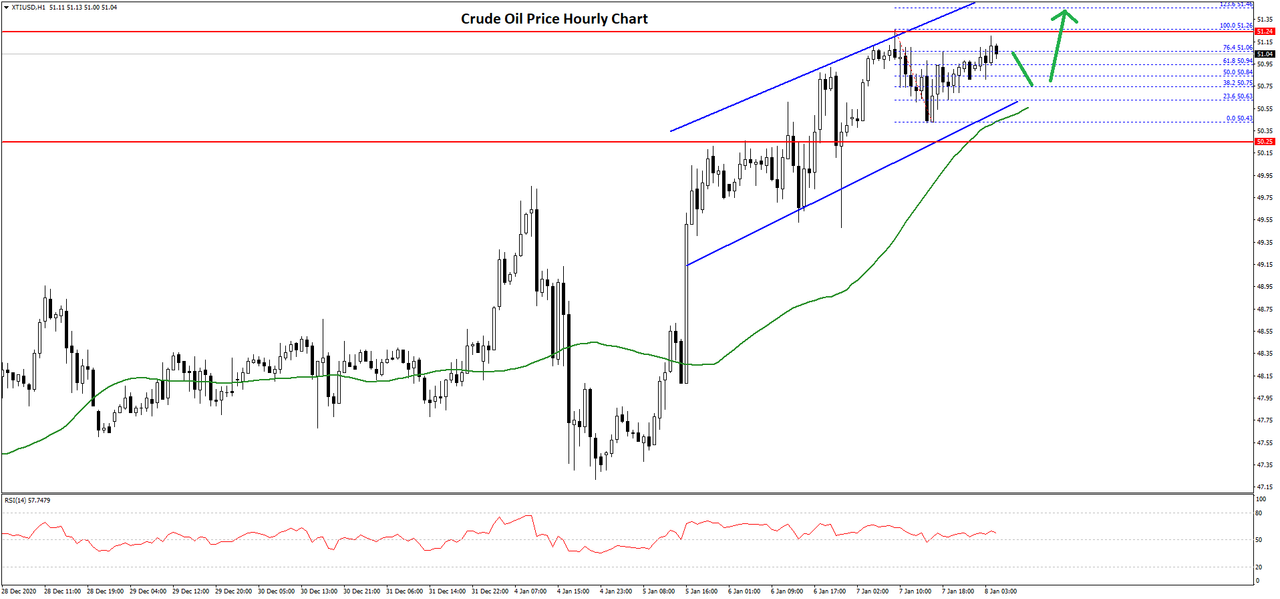

- Crude oil price surged above the $48.00 resistance and it even broke the $50.00 barrier.

- There is a key rising channel forming with support near $50.60 on the hourly chart of XTI/USD.

Gold Price Technical AnalysisGold price started a fresh increase above the $1,910 resistance level against the US Dollar. The price broke the $1,925 and $1,950 resistance levels to move into a positive zone.

The price even traded close to the $1,960 before it faced sellers. A swing high was formed near $1,959 on FXOpen before the price started a downside correction. There was a sharp decline below the $1,950 and $1,940 levels.

During the decline, there was a break below a major bullish trend line with support near $1,920 on the hourly chart of gold. The price traded below the 50% Fib retracement level of the upward move from the $1,872 swing low to $1,959 high.

It even settled below the $1,920 level and the 50 hourly simple moving average. It seems like the price is approaching the $1,905 and $1,900 support levels. The 61.8% Fib retracement level of the upward move from the $1,872 swing low to $1,959 high might also provide support.

Any more losses could lead the price towards the $1,880 support level. Conversely, the price could attempt a fresh increase above the $1,915 and $1,920 resistance levels.

A successful close above the $1,920 and the 50 hourly simple moving average could open the doors for a decent increase in the coming sessions. The next major resistance is near the $1,950 level.

Oil Price Technical AnalysisCrude oil price started a steady rise after it broke the key $48.00 resistance zone against the US Dollar. The price broke many hurdles near $50.00 to move further into a positive zone.

The price even broke the $51.00 level and settled above the 50 hourly simple moving average. It traded to a new multi-month high near $51.26 before starting a downside correction. It declined towards $50.50 level and it is currently rising.

There was a break above the $50.80 resistance. The price recovered above the 50% Fib retracement level of the recent decline from the $51.26 high to $50.43 low.

It is now trading above the 76.4% Fib retracement level of the recent decline from the $51.26 high to $50.43 low. Therefore, there are high chances of a break above the $51.20 and $51.50 resistance levels in the coming sessions.

On the downside, an initial support is near the $50.80 level. There is also a key rising channel forming with support near $50.60 on the hourly chart of XTI/USD.

If there is a downside break below the channel support trend line, the price could decline towards the $50.00 support level. The next major support sits near the $49.55 level.