Gold Price Showing Bearish Signs While Oil Price Outperforms

Gold price failed to surpass the $1,875 resistance and started a fresh decline. Conversely, crude oil price traded to new multi-month high close to $48.00 level.

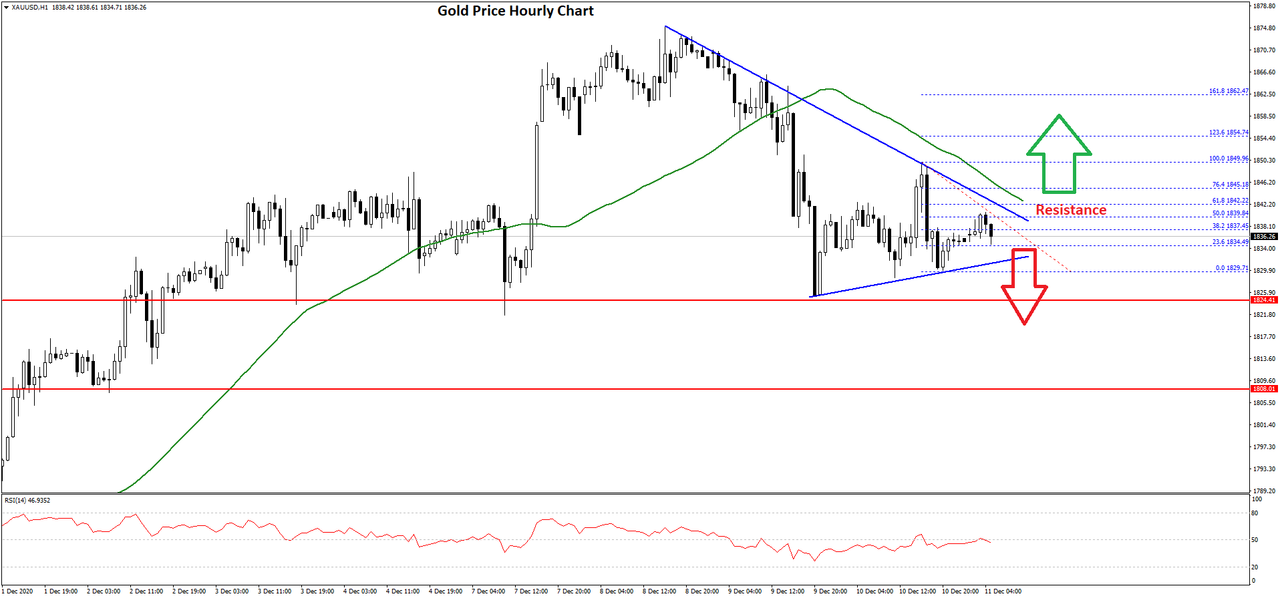

Important Takeaways for Gold and Oil- Gold price started a fresh decline below the $1,870 and $1,850 levels against the US Dollar.

- There is a major contracting triangle forming with resistance near $1,840 on the hourly chart of gold.

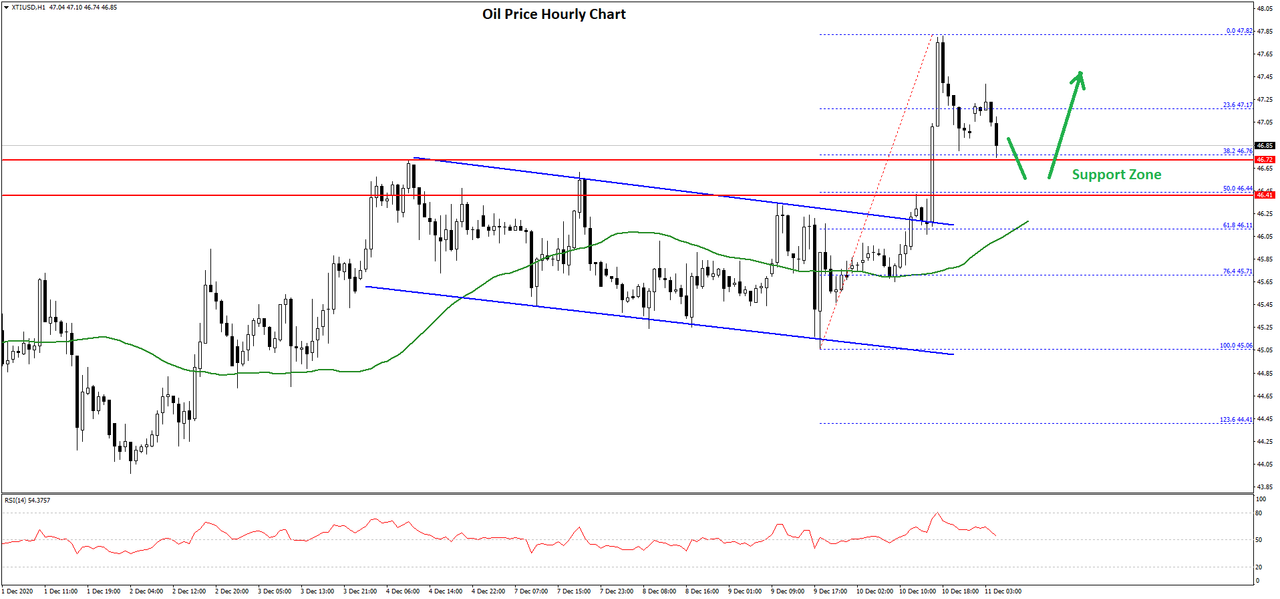

- Crude oil price surged above the $46.75 resistance and traded as high as $47.82.

- There was a break above a key declining channel with resistance near $46.20 on the hourly chart of XTI/USD.

Gold Price Technical AnalysisGold price started a fresh increase above the $1,800 support zone against the US Dollar. The price broke the $1,840 and $1,850 resistance levels to gain bullish momentum.

However, the price struggled to clear the $1,875 resistance. A high was formed near $1,875 on FXOpen and the price started a fresh decline. There was a clear break below the $1,855 support zone and the 50 hourly simple moving average.

The price even broke the $1,840 level and traded close to $1,825. The price is currently consolidating above $1,825. The recent swing high was near $1,849 before the price declined to $1,829.

It is currently trading above the $1,832 level. There was a break above the 23.6% Fib retracement level of the recent decline from the $1,849 swing high to $1,829 low. On the upside, the price is facing hurdles near the $1,840 level.

Moreover, there is a major contracting triangle forming with resistance near $1,840 on the hourly chart of gold. The triangle resistance is close to the 50% Fib retracement level of the recent decline from the $1,849 swing high to $1,829 low.

A successful close above the triangle resistance, $1,840, and the 50 hourly simple moving average could open the doors for a decent increase in the coming sessions. The next major resistance is near the $1,850 level.

Conversely, the price could continue to move down below the $1,830 and $1,828 levels. The next major support is near $1,810, below which there is a risk of a sharp decline towards $1,780. Any further losses could lead the price towards the $1,750 support zone.

Oil Price Technical AnalysisCrude oil price remained well bid above the $44.00 and $45.00 levels against the US Dollar. The price broke many hurdles near $45.50 to move further into a positive zone.

The bulls remained in action and there was a clear break above the $46.75 resistance. During the rise, there was a break above a key declining channel with resistance near $46.20 on the hourly chart of XTI/USD.

The price even broke the $47.20 resistance and settled well above the 50 hourly simple moving average. It traded close to the $47.85 level and a high is formed near $47.82.

Recently, there was a downside correction below the $47.50 level. There was a break below the 23.6% Fib retracement level of the upward move from the $45.06 swing low to $47.82 high.

On the downside, the previous resistance near $46.75 is acting as a strong support. The next major support is near the $46.50 level or the 50% Fib retracement level of the upward move from the $45.06 swing low to $47.82 high.

On the upside, the price is facing hurdles near the $47.25 level. A close above $47.25 might set the pace for a fresh leg higher towards the $48.00 level.