b. Price Movements Reflect Everything (Price Discount Everything)

According to Dow, the market has reflected all information available through prices. Price is an accumulation of all things, fear, hope and expectations of all traders. Likewise, the movement of interest rates, expectations of income, income projections, presidential elections, etc. all have been reflected in prices in the market. What has not been described is just an unexpected event, such as a natural disaster, but usually this will affect short-term trends. The main trend is not affected. The most important thing according to Dow is not what can cause prices to move now but what reactions might occur to current price movements.

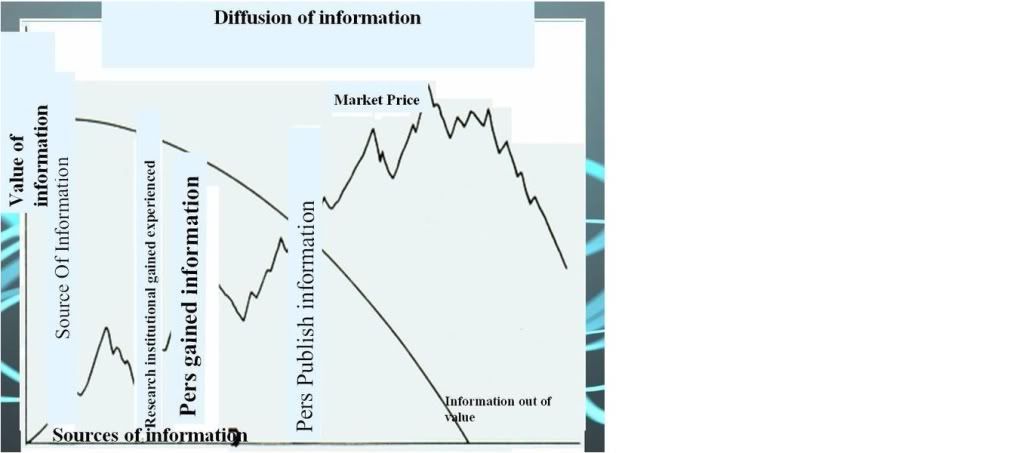

All information that has been reflected in price movements is in accordance with the theory of information diffusion. The diffusion of information is illustrated in the image below:

Spoiler:

Spoiler:

Another illustration can be exemplified when a company wants to release its financial statements, people who know information about the state of the company, of course, the people in the company itself, when they know the condition of a positive company, they will tell people nearby to buy shares of their company and the price will move up. Then came the auditors and the tax people, when they knew the condition of the company, they would take the momentum to buy the shares then the price would continue to move up.

The excitement of the press people gets the information, before the news release schedule, they will try to take advantage of the information obtained to participate in buying shares, and prices go up further which results in the reduced value of information.

When the news was released in various media, more and more people knew, so the value of information would be close to zero while prices still continued to rise. At this point, the first buyer begins to release the shares that they have bought for profit. Finally when many people sell because prices are considered high and the profits they feel are enough, then prices tend to turn down (reversal) and the value of information has really become zero. (Quoted from the article: The Dow Theory, Speaking The Truth About Technical Analysis, by: Aditya)

Sometimes anomalies occur in the market. Hamilton noted that sometimes markets will react negatively to good news. According to Hamilton, the reason is simple: the market looks forward, when the news will be released. This explains the old Wall Street axiom, "buy on rumors, sell on news".